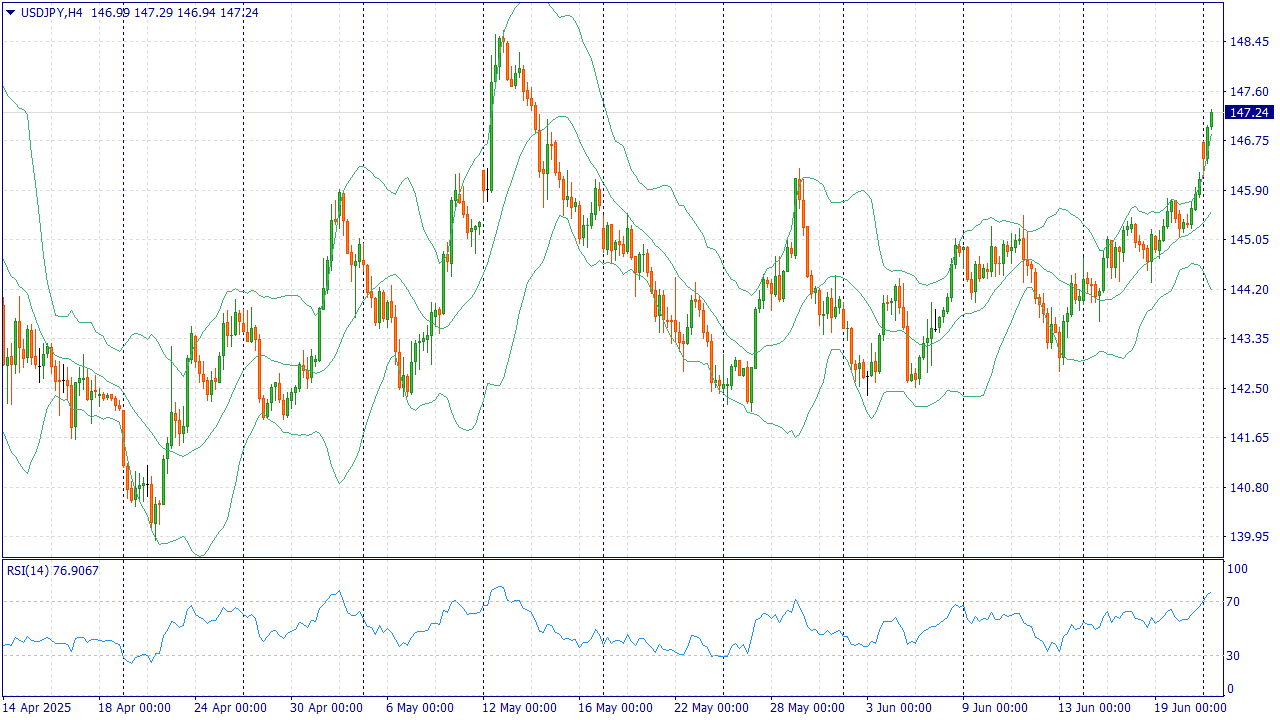

USDJPY: BUY 147.20, SL 146.80, TP 148.40 | 24 June 2025

24 June 2025, USD/JPY

An event to watch out for today:

16:45 EET. USD - Manufacturing PMI

USDJPY:

The Japanese yen (JPY) is starting the new week on a weaker note, falling to its lowest level since May 15 against the stronger US dollar (USD) during the Asian session. Last week, the Bank of Japan (BoJ) signaled that it prefers to proceed cautiously in normalizing its still-accommodative monetary policy, prompting investors to postpone their expectations regarding the likely timing of the next interest rate hike. In addition, concerns that existing 25% US tariffs on Japanese cars and 24% retaliatory duties on other imported goods will affect the Japanese economy were another factor undermining the JPY.

Meanwhile, Japan's annual consumer price index (CPI) in May remained well above the BoJ's 2% target, giving the central bank additional incentive to raise interest rates again in the coming months. In addition, Japan's PMI data released on Monday, which was better than expected, confirms the need for further rate hikes by the Bank of Japan. Moreover, the risk of further escalation of geopolitical tensions in the Middle East after the US bombing of key nuclear facilities in Iran on Sunday may play into the hands of the yen as a relatively safe asset. This could further limit the growth of the USD/JPY pair.

Trading recommendation: BUY 147.20, SL 146.80, TP 148.40

Top up your account and get up to 15% in your balance on your first deposit. The additional funds will be used for trading, increasing trading volumes and helping to withstand drawdowns.