Abundance of news events may change the situation on the euro against the dollar | 22 August 2024

22 August 2024, EUR/USD

Events to watch out for today:

11:00 GMT+3. EUR - Composite PMI

15:30 GMT+3. USD - Initial Jobless Claims Number

16:45 GMT+3. USD - Composite PMI

EURUSD:

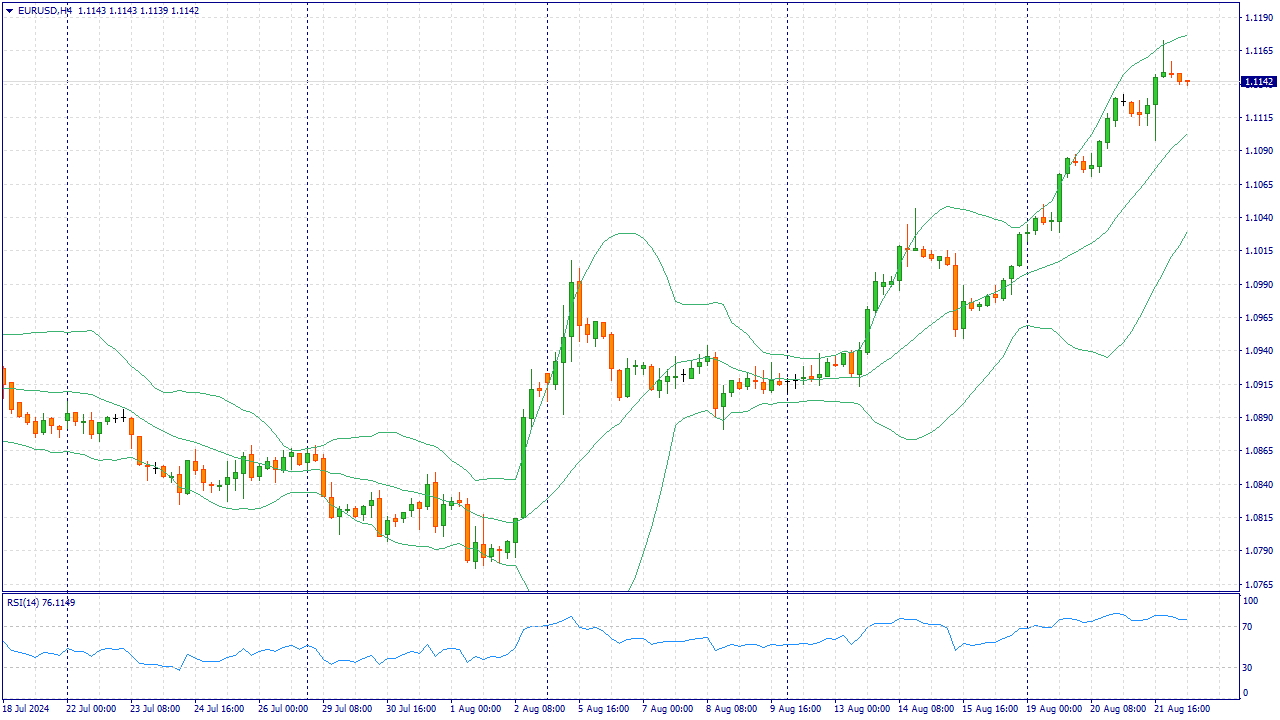

EUR/USD traded with small losses near 1.1145 during the Asian session on Thursday. The major pair's decline is likely to be limited amid growing expectations that the US Federal Reserve (Fed) will begin easing its monetary policy in September. Later on Thursday, preliminary purchasing managers' indices (PMIs) for August from the eurozone and the US will be released.

Minutes of the 30-31 July Fed meeting released on Wednesday showed that most Fed officials agreed last month that they would likely cut interest rates at their next meeting in September as long as inflation continues to fall. Atlanta Fed President Raphael Bostic said: ‘We may have to change our policy stance sooner than I had previously thought’.

Fed Chairman Jerome Powell's speech at Jackson Hole may provide some hints as to how the US interest rate will change. Markets expect Powell to make it clear on Friday that inflation is on track to meet the Fed's 2% target. Any dovish remarks from Fed officials could put pressure on the US Dollar and create a tailwind for EUR/USD.

On the other side of the pond, European Central Bank (ECB) policymakers refrained from a concrete path of interest rate cuts, citing expectations that Eurozone inflation will remain at current levels for the rest of the year. However, ECB chief Olli Rehn said on Monday that the ECB may have to cut interest rates again in September due to continued economic weakness. Markets have estimated the probability of a 25 basis points (bps) deposit rate cut to 3.5% in September at almost 90% and believe there will be at least one more move before the end of the year.

Trading recommendation: Trade mainly with buy orders at the price level of 1.1170. We consider sell orders at the price level of 1.1100.

Our company provides an opportunity to earn income not only from your trading. By attracting clients within the affiliate program, you can get up to $30 per lot!