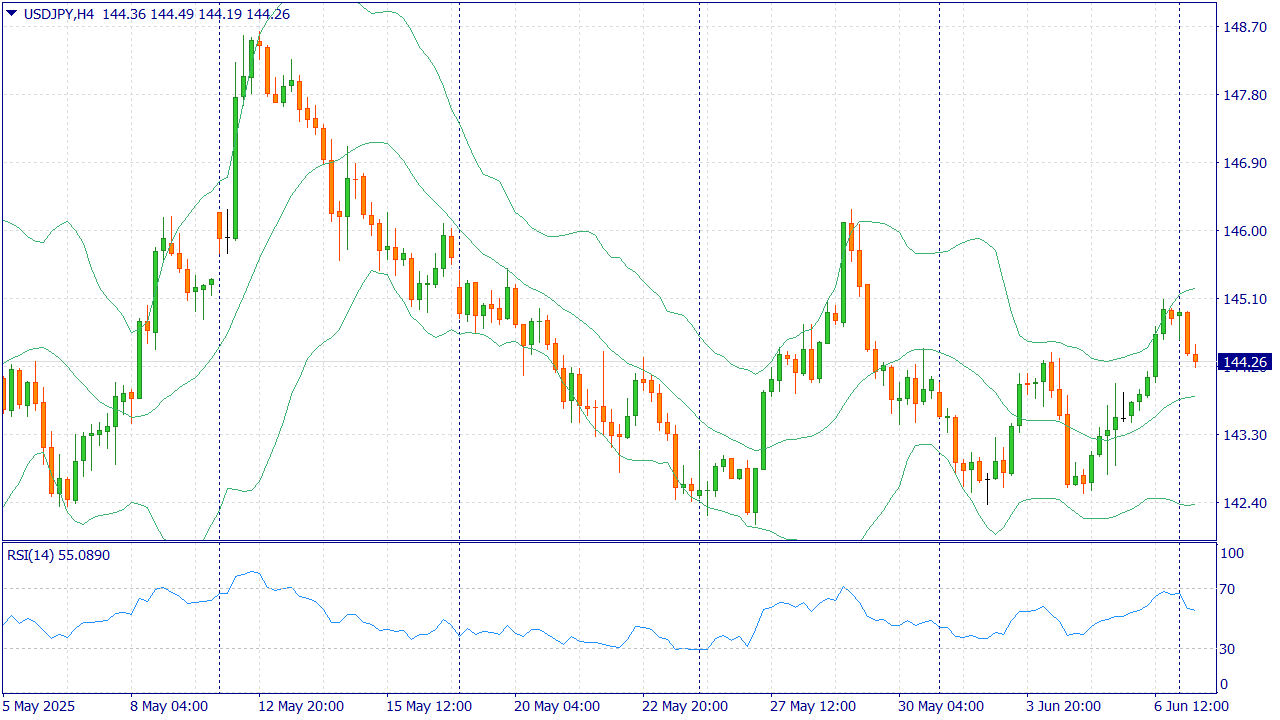

USDJPY: SELL 143.85, SL 144.85, TP 141.85 | 10 Junio 2025

10 Junio 2025, USD/JPY

USDJPY:

The Japanese Yen (JPY) is rising at the start of the new week, reacting to upward revisions to Japan's first quarter GDP data. This comes amid signs of rising inflation in Japan and confirmation of bets that the Bank of Japan (BoJ) will continue to raise interest rates, which in turn provides a slight boost to the JPY. In addition, a modest decline in the US Dollar (USD) is putting some downward pressure on the USD/JPY pair during the Asian session.

For now, the Yen appears to have broken a two-day losing streak against its US counterpart, although traders may refrain from aggressive directional bets ahead of key US-China trade talks in London. In addition, stronger-than-expected US jobs data released on Friday dampened hopes that the Federal Reserve (Fed) will cut interest rates soon this year, which could serve as a tailwind for the dollar and limit USD/JPY pair losses.

Trade recommendation: SELL 143.85, SL 144.85, TP 141.85

Our company provides an opportunity to earn income not only from your trading. By attracting clients within the affiliate program, you can get up to $30 per lot!