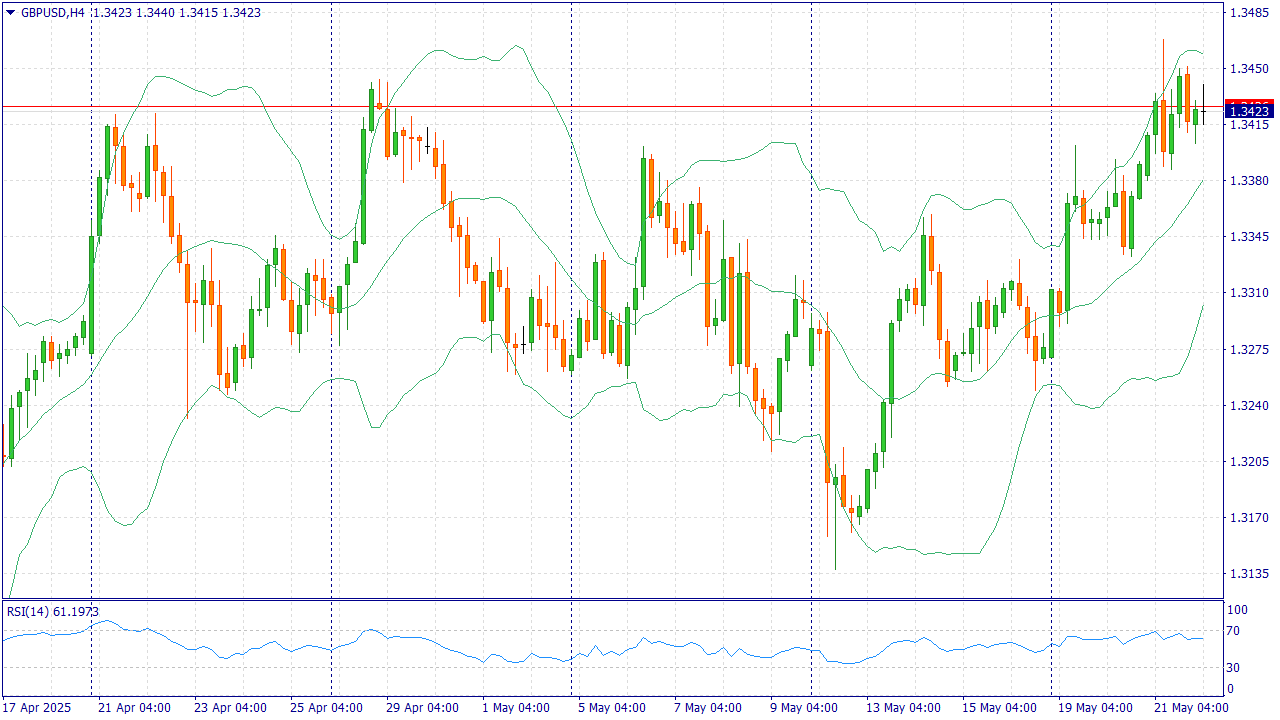

GBPUSD: BUY 1.3450, SL 1.3380, TP 1.3550 | 23 May 2025

23 May 2025, GBP/USD

Events to pay attention to today:

15:30 EET. USD - Unemployment Claims

16:45 EET. USD - Services PMI

GBPUSD:

The GBP/USD pair rose for the fourth consecutive day, trading around the 1.3430 mark during Asian hours on Thursday. The pair's rise is attributed to a weaker US dollar, which continues to face challenges after Moody's downgraded the US credit rating from Aaa to Aa1, following similar downgrades by Fitch Ratings in 2023 and Standard & Poor's in 2011.

Moody's has forecast that US federal debt will rise to 134 per cent of GDP by 2035, up from 98 per cent in 2023, and that the budget deficit will widen to nearly 9 per cent of GDP. This deterioration is attributed to rising debt service costs, expanding entitlement programmes and declining tax revenues.

On Monday, Cleveland Fed President Beth Hammack and San Francisco Fed President Mary K. Daley expressed growing concern about the health of the U.S. economy during a panel event hosted by the Federal Reserve Bank of Atlanta. While key economic indicators continue to demonstrate strength, both officials acknowledged a decline in consumer and corporate confidence, attributing this shift in sentiment to the impact of US trade policy.

On Wednesday, the British pound (GBP) continued to rise in value following the release of the UK Consumer Price Index (CPI) data for April, which was better than expected. The United Kingdom (UK) Office for National Statistics has reported that the Consumer Price Index (CPI) rose 3.5% year-on-year, compared to forecasts of 3.3% and March's reading of 2.6%. This represents the highest level since November 2023. Meanwhile, core inflation rose 1.2% for the month, compared to a forecast of 1.1% and the previous reading of 0.3%.

Stronger-than-expected UK data has shown inflationary pressures to be rising, which is a key factor in preventing the Bank of England (BoE) from continuing to maintain expansionary monetary policy. Traders are likely to monitor the release of S&P Global's Purchasing Managers' Index (PMI) data, scheduled for Thursday.

Trading recommendation: BUY 1.3450, SL 1.3380, TP 1.3550

Connect Drawdown bonus 101% and trade with double your deposit! Bonus funds will help you increase your profits or withstand a sudden drawdown!