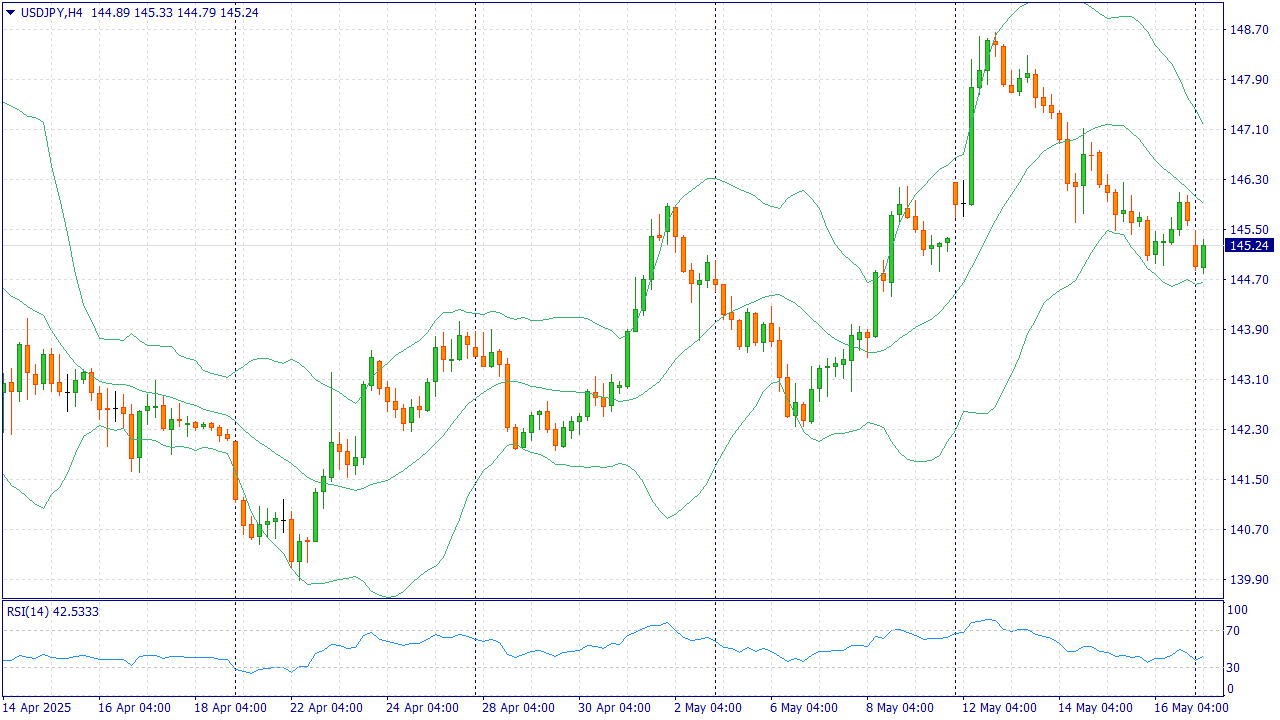

USDJPY: SELL 144.70, SL 145.50, TP 143.80 | 20 May 2025

20 May 2025, USD/JPY

USDJPY:

The USD/JPY pair attracted new sellers on Monday and fell to a one-week low of around 144.80 during the Asian session. Furthermore, the current economic climate suggests that the path of least resistance for spot prices remains to the downside, which supports the prospects for a continuation of the recent corrective decline from the nearly six-week high reached last Monday.

It is widely anticipated that the Bank of Japan (BoJ) will raise interest rates again in 2025, a development that is expected to continue providing support to the Japanese Yen (JPY). Furthermore, the unexpected downgrade of the US government's credit rating is discouraging investors from taking risks and is instead favouring traditional safe-haven assets, including the Japanese Yen. On Friday, Moody's downgraded America's main sovereign credit rating by one notch, to 'Aa1', citing concerns over the country's rising debt.

Meanwhile, investors seem convinced that the Federal Reserve (Fed) will continue to cut rates amid signs of weakening inflation and the likelihood that the US economy will see several quarters of sluggish growth. At the start of the new week, the US Dollar remains depressed and exerts additional downward pressure on the USD/JPY pair. However, the lack of follow-through selling below the psychological 145.00 mark is forcing bears to exercise caution before positioning themselves for deeper losses.

On Monday, the US will not release any market-moving economic data, so the dollar will be influenced by speeches by influential FOMC members. Furthermore, an improvement in risk sentiment is likely to result in increased demand for the Japanese Yen, thereby providing some momentum to the USD/JPY pair. However, the diverging policy expectations of the BoJ and the FOMC confirm the negative outlook for the near term. Consequently, any recovery attempt could be perceived as a strategic opportunity for divestment, and is likely to be constrained.

Trade recommendation: SELL 144.70, SL 145.50, TP 143.80

Up to $20 for each lot in real money - get a guaranteed income by connecting Cashback promotion!